Should hoarding be praised?

Notes

- This article is originally from 2018. I have since updated some of the figures with more recent stats. My English has also improved since then, so there were some grammar fixes.

- I wrote the original article before the boom and bust of the NFTs and I doubt that the term was mainstream back then. I am not including anything about NFTs in my edits. The message of the article is relevant though and has aged well.

- I have used the term "squatting" only in relation to online communities. Squatting (as in homesteading) in the built-space is a whole different topic and not the subject here.

While some people like to collect shoes, the vast majority of the population buys shoes to envelope their feet. The global footwear market is at $365.5B. Meanwhile, the collectible shoe market is a tiny $6B (1.6% of the total).

Think about how insignificant the shoe market would have been without a utility for the shoe. Its collectible market may not have even existed.

A lot of things have the same utility-speculation duality. Diamonds, for example, are jewelry but also very useful for excavation and milling.

Makers want to use the thing and speculators want to hoard it until it is more valuable. The speculators get stronger when there is scarcity, choking out the supply and squeezing out the makers. Let's discuss that in real estate first, then get to where all conversations go nowadays: Bitcoin.

Hoarding land

Speculators are a group of early observers who want an easy way to leverage impending growth. When the city land is limited, speculators tap into this limitation by holding a piece of it for themselves. This naturally inflates the prices.

City planners have learned to look out for the kind of fallacy. More real estate activity is not necessarily better for the city. The early cases of downtown deaths were self-inflicted due to zoning policies, lack of housing strategy, and rampant speculation. Downtown is for people as Jane Jacobs puts it.

High home prices in squeezes out the most active residents: middle-income young households. Some speculators may have made money in this example but in reality they are turning a hidden balancer into cash for themselves. They have made their money at the expense of taking away the city's vibrance.

That said, today most communities clearly have failed to house everyone who can contribute to their future. People are being pushed out of places close to their work.

Drive until you qualify

This is becoming a more common saying. It means drive outward from the urban core until you reach somewhere that homes are affordable enough for you.

Hoarding website names

When it comes to online domains, speculators haven't been able to cause as much disruption because the online "land" keeps expanding (unlike land). In the past decade or so, many new top-level domains have emerged, making it easy to have a short and brandable domain name. Still though, .com is the most attractive domain space.

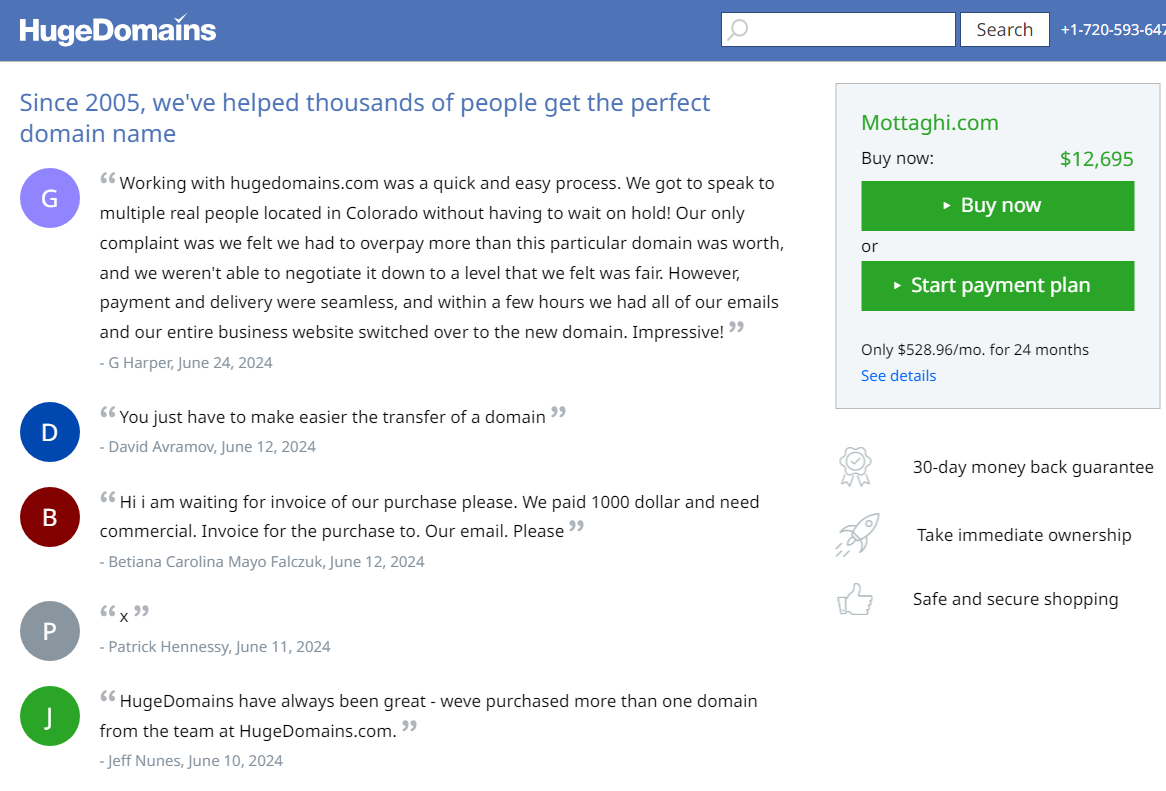

I looked up my family name's .com website to see if it is available. As you will find out upon trying, Mottaghi.com was listed by a company called HugeDomains, for "only $2,795" (increased to over $5,000 in 2021) even though my family name is very specific (double "T"s). It says the brandability of it is "very high". A questionable claim at best.

(2024 update: Their "price" has shot up to over $12,000 and the website is clearly in disarray. Also added a screenshot below.)

When you want to buy an unregistered website, you pay an annual fee to the registrar — typically .com is $9/yr. HugeDomins thought someone might be interested in the website and bought it in 2012 to re-sell it at a higher price. Every year they keep paying the small fee to hold it, in the hopes that someone (me probably) buys it off their hand. They claim to have 4 million websites like this.

They don't have to do this, they benefit no one from doing this but themselves.

This is an example of cybersquatting. ICANN has some protections against it but they are only about trademarks. HugeDomain can argue that it's not "profiting from the goodwill of someone else's trademark" and say it is providing value via the website, while it is open to offers.

How they have found out that someone like me would be interested in buying a website is a whole other story, but that is quite an investment for them: about $70 (over $100 as of 2024) so far accumulated annual fees based on my rough calculation. They are trying to get a 40-fold (120-fold as of 2024) return on that.

And this is in no way only my story. In fact, go to .com of any 3, 4, or 5 digit number that you can think of (e.g. 42983.com) and see that it is already taken. To understand where companies like HugeDomains get the incentive and patience to do such thins, we should talk about the early days of the internet.

It's 2003. The Vancouverite, Caterina Fake and her team decide to pivot from making a game, to making a "photo sharing thing" they had almost randomly come up with. They wanted to name the website Flicker. Fair enough, though someone had registered flicker.com back in 1998. So they dropped the "e" from the name which turned out to be an ok marketing move.

Today flicker.com does route to flickr.com; presumably it was bought after Flickr had deep enough pockets to buy it from its original owner. I admit that the story does not really say much about how legit flicker.com was in the first place. The point is that the resources (good website names) are not being given to whoever utilizes them the most; they are being given to whoever got there first.

Of course that's because it is not clear who will be the value-maker, but the question is: do the squatters create any value? They jumbled up website names. Many makers simply sidesteped the squatters and found a less-than-ideal name that should work.

If you want to buy a Kayak, you go to Amazon.com; if you want to book a trip to the Amazon's, you go to Kayak.com.

Website names have no relation to their function, and that's why google is in business. Next time you are searching for something, type it in the address bar and put a .com in front of it. Do you see a functioning website that would have been your choice?

As I am writing this, I randomly decided to go to fedorahats.com. I was greeted with a blank screen and definitely no hats. The website is registered, it just doesn't show anything.

Imagine an internet where all websites were already bought, but none is functioning. The prices are appreciating in value because one day the killer app will show up, and it wil be all worth it. Will you use that internet? Probably not. Too much hoarding ends up killing the ecosystem.

That is the perfect segue into cryptocurrencies.

Hoarding lines of code

Today's crypto exchanges resemble the registrars of early internet era. Hodling, resembles Cybersquatting. ICOs resemble top-level domain additions, including my favorite one: A name space for the moon.

That being said, speculation in cryptocurrencies is less like the internet domain name speculation and more like land speculation. The coordination issues that the likes of Bitcoin and Ethereum are trying to solve cause a lot of limitations. The amount of data that can be propagated in the network is small because that data needs to be stored indefinitely. By design, only around 6 MB can get added to the Bitcoin blockchain every hour, containing transactions and data. There is a clear limitation of resources to the level that the speculation leaves little room for the makers.

Speculation leads to innovation ?

ARK Invest is getting a lot of industries right. Though I'm not sure where the above sentence is coming from. I have only seen them say it. A. Few. Times..

(2024 update: ARC Invest is doing disastrously so I guess speculation doesn't lead to innovation after all.)

From what we can see in crypto, speculation only leads to more marketing efforts, and more altcoins. Altcoins are not solutions to any of this. They are not the same as people avoiding a squatted .com domain by buying .lol. All website domains are on the same network. Altcoins operate on their own networks. They are similar to how Microsoft had its own internet (MSN) that had no connection to the internet we use today.

Vitalik had trouble finding developers for Ethereum simply because the developers figured they can do their own things. Most of these projects have hilariously low 51% attack costs. Speculation did lead to more Bitcoin forks, more lines of code, more press releases, and more Telegram supergroups, but more innovation? Most of the innovation was already there.

Trading crypto for its price is as shallow as trading websites for their names, the real value that created the internet came from somewhere else.

In cryptocurrencies, speculators invest on the assumption that the technology has more value than its current price without concrete evidence. Similar to the cybersquatting example, I saw first hand how the clash of makers and speculators unfolded in Bitcoin. Unlike the web, the users could not just side-step the speculators because there were few things that could be done for the 6MB per hour data limit.

There was a time that you could send a Bitcoin transaction with little to no fee, and see it go through. This stopped being the case pretty much as soon as there was price traction. Let's look at Bitcoin by the end of 2017. The speculator saw that the prices were rising, so it was the time to invest. This could have been ok for someone who wanted to buy coffee with Bitcoin, but because of the scalability limitation, the coffee buyer could not compete with the speculator over the transaction fees. One was transferring coffee money while another was investing life savings. Of course the fees they tolerate for their transactions is wildly different. As a result, we have less Fortune500 companies that support crypto from before. (2021 update: this is not true anymore, on paper. In reality, the added support is coming from off-chain services. Read more here.)

Hoarding is simple

So hoarding a resource is not without its external effects. Could there be a simpler way to invest on scarcity?

For the web, investing on internet companies is one obvious approach. Still, it's not the same thing. Hoarding website names is investing on the internet itself. It's also not the same thing as buying internet infrastructure. Buying infrastructure does not have the early adopter benefits; the benefits from it do not compound over time. Buying a whole domain name-space ("dot something") does provide the benefits of cybersquatting, though it needs a huge upfront investment and a fair bit of marketing savvy.

Buying a website name is like buying some state bonds in the currency that they are provided. The prosperity of the country is the prosperity of the bonds.

To its credit, cybersquatting is beautifully simple for the advantages it gives the investor. There are good reasons however, to take a harder route.

You commission a carpenter to make a chair for $50. the carpenter buys $30 of lumber and works on it for $20. Everyone can close their accounting books, but in this process raw wood has turned into something usable. Perhaps you give this chair to an employee who can sit on it and have higher efficiency as a result.

How about a cryptocurrency? Does turning computation into an online medium to transfer funds create added value? Probably not if two bots are transferring the amounts back and forth. Allowing myself to be naive here, the first value driver is the community around the technology.

Things that emerge quickly, fade quickly too. This phenomenon (being some sort of social media law that I can't seem to locate) has been well-spotted in fashion, in investment, and even architecture. The personal example of this for me is helping out with "intro to crypto sessions" at a community space. After the last crypto boom-bust cycle. It has gone from a packed room to only about 3 people every time. One of them asks how they can get rich.

There is eventually a community being built. The goal of its members is the question. A community of speculators will have an effect opposite of what each member is looking for. A community of makers is not going to run into the same issue. Making that community is harder than speculation though.

So, are we winning?

Imagine you are a citizen of the tenth century, standing with three wise men of your era. One of them says he is very close to turning copper into gold, the second one believes that the earth is round, and the third one offers to improve your mood and health by balancing your four temperaments.

Alchemy and Humorism were, respectively, the foundation of Chemistry (with the same name origin) and modern medicine (although not before killing George Washington); however, these two fields were nothing more than an assembly of anecdotes. Only the most absurd idea out of the above three turned out the be true and a case for following the scientific method.

What might seem obvious now, needed centuries of development to give birth to the scientific method. We should keep in mind that modern scientific disciplines each started as yet another fringe idea with their critics. It seems as if in every historical period, only a small portion of the workforce randomly gave birth to a revolutionizing concept, while many unsuccessful (but necessary) attempts were made by others.

For most of history, people believed that the economy is a zero-sum game (economy is belief after all). In other words, being rich meant that you have taken other people's share, because the pie was a fixed size. In the modern economy we don't see the wealth growth like this because the rich leverage (or at least should leverage) from the growth of the pie.

In a global scale, the industrial revolution killed the myth of the zero-sum economy. The gave birth to the new science of economics; however, it is sill perfectly possible to have zero-sum games. A new venture cannot easily determine whether it is in a zero-sum game or not.

Pure hoarding is a sure-fire way to make a zero-sum venture. Money just changes hands and nothing gets built. Participating in such venture is not the best idea, because:

- The are not enough prizes for everyone: Some players may become rich and famous but at no point in time everyone wins. For having winners, there must always be losers. There have been as much effort to define the "why" of the community as its "what"*. But let's say the overarching concept is that "community is a mutual activity for attaining a goal". In a zero-sum game there is nothing mutual and there is nothing to attain; your goal is already in the pocket of the next person.

- Mass education has no value: More educated participants make a zero-sum game uneventful. Each player sees the most benefit if they possess the most information and know-how compared to others; thus, having more competent users is a bad thing. This disincentives education and openness among the players, the exact opposite of what has caused economic booms around the world.

- The student government problem emerges: Players join the game just to leave it. The moment of triumph for an speculator is when they cash out and never look back. This effect can spectacularly derail a movement. On the contrary, in a healthy society, the players gain more connections and support during their activity. They loose all of that if they choose to leave.

Learning this I have stopped participating in many games. Not being involved in the game makes it even more entertaining to watch. I'm looking forward to seeing how long HugeDomain will sit on that "highly brandable" domain.